How Much Is Car Insurance in Louisiana per Month? Find out!

Curious About Car Insurance Costs in LA?

Are you asking “how much is car insurance in Louisiana per month?” You’re not alone. Insurance rates in our state vary widely—so let's unpack the numbers, why they fluctuate, and how you can get the best agreement for your needs.

In Louisiana, driving without insurance can lead to fines, vehicle impoundment, and even a suspension of your registration.

Why Rates Vary in Louisiana

Insurance isn’t one-size-fits-all—especially in Louisiana. Several unique factors in our state can cause your monthly premium to go up or down. Here's what makes a big difference:

Location & Weather Risk

Louisiana drivers often pay more simply because of where they live. Areas like New Orleans, Baton Rouge, and Lake Charles are prone to hurricanes, flooding, and hail, all of which increase the likelihood of claims. Insurance companies raise premiums in high-risk zones to account for this added exposure.

📌 Example: A driver in Lafayette might pay $30 less per month than someone with the same car and record in a high-flood area of New Orleans.

Driver Profile

Who you are plays a big role. Your age, gender, marital status, and how long you’ve been driving all influence your premium. Younger drivers (especially under 25) are considered riskier. Statistically, they’re more likely to be involved in accidents.

📌 Example: A 19-year-old male driver might pay over $300/month, while a 40-year-old married female with a clean record might pay under $150.

Coverage Level

There’s a big difference between bare-minimum liability coverage and full coverage that includes collision + comprehensive. Liability-only is cheaper month to month but covers less. Full coverage gives more protection but costs more—especially if you have a new or financed vehicle.

📌 Tip: If your car is older and paid off, liability might be enough. But if it's newer or financed, full coverage is usually required by lenders.

Vehicle Type

What you drive matters. Expensive, sporty, or luxury cars often cost more to insure because they’re costlier to repair or more likely to be stolen. On the flip side, older, lower-value vehicles usually come with lower premiums.

📌 Example: A new Dodge Charger may cost $220+/mo to fully insure, while a 10-year-old Honda Civic might be closer to $120.

Credit & Discounts

Yes, your credit score can affect your rate in Louisiana. Insurers see it as a reflection of how likely you are to file a claim. The better your credit, the lower your rate tends to be. Discounts—like for bundling, good driving, or safety features—can also shave off 5–20% or more.

📌 Pro tip: Ask about hidden discounts like paperless billing, paying in full, or having a low-mileage commute.

What Impacts Your Monthly Rate?

Several personal and vehicle-related details affect how much you pay for car insurance each month in Louisiana. Here’s how each one plays a role:

1. Age & Experience

Younger drivers, especially teens and those under 25, are statistically more likely to have accidents—so insurers charge more to offset that risk. As you gain experience and maintain a clean record, your rates generally go down.

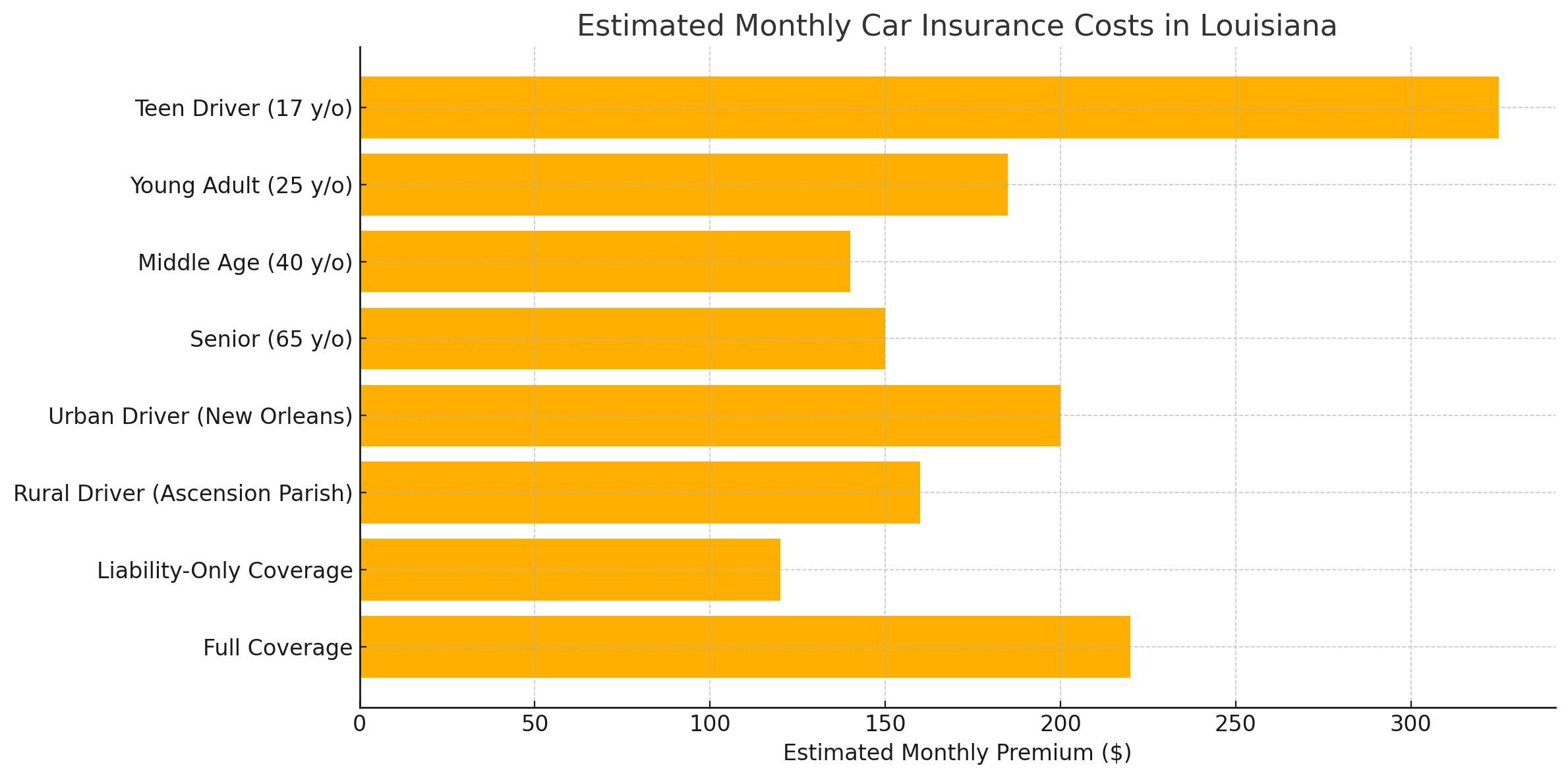

📌 Example: A 17-year-old new driver in Baton Rouge might pay $325/month, while a 35-year-old with 10+ years of driving history and no claims could pay just $130/month for the same coverage.

2. Coverage Choices

The more protection you choose, the more you’ll pay monthly. State-minimum liability coverage is the cheapest, but it only covers damage you cause to others—not your own vehicle. Full coverage includes liability, collision (for accidents), and comprehensive (for non-collision issues like theft or hail).

💡 Add-ons like roadside assistance, rental reimbursement, and gap coverage (for loans/leases) will increase your premium by $10–$40/month depending on your insurer and car.

3. Location Type

Living in a dense city like New Orleans or Baton Rouge means more traffic, more accidents, and higher rates of car theft. Rural areas generally have lower premiums due to less congestion and fewer claims filed.

📌 Example: A driver in rural Ascension Parish might pay $40/month less than someone in downtown New Orleans with the same car and record.

Urban vs. Rural Areas for Car Insurance in Louisiana:

Urban Hotspots: New Orleans, Baton Rouge, Shreveport, and Lafayette are shaded with higher population density. These areas tend to have increased traffic congestion, accident rates, and vehicle theft, all of which drive insurance costs higher.

Suburban & Rural Regions: Parishes outside metro zones—like Ascension, Vernon, or Sabine—see fewer claims, fewer accidents, and lower theft rates, leading to reduced premiums.

4. Driving History & Credit

Insurance companies reward safe, responsible drivers. If you’ve had speeding tickets, at-fault accidents, DUIs, or a lapse in coverage, expect to pay more. Your credit score also plays a role—better credit typically equals lower risk in the eyes of insurers.

📌 Tip: Many companies offer discounts for accident-free driving, taking a defensive driving course, or joining a telematics (driver tracking) program.

5. Vehicle Details

The type, age, and condition of your car directly influence your premium. High-end cars are more expensive to repair or replace. Older cars usually cost less to insure—especially if you opt for liability only.

📌 Example: A brand-new SUV with collision + comprehensive might cost $200+/month, while a 12-year-old sedan with liability-only might cost around $90/month.

6. How Much You Drive (Vehicle Usage)

How often and how far you drive plays a role in what you pay. People with long daily commutes or who drive for work (like delivery or rideshare) usually face higher premiums because they spend more time on the road—which increases the chance of an accident.

On the flip side, low-mileage drivers (under 7,500 miles per year) may qualify for special discounts or even pay-per-mile insurance options that can significantly reduce costs.

📌 Example: A driver who works from home and drives just a few times a week could save $25–$50/month compared to someone commuting 40 miles a day.

How to Lower Your Monthly Premium

f your car insurance feels too expensive, you're not stuck with it. There are several proven ways to reduce your monthly premium—many of them quick and easy. Here's how:

Bundle Your Policies

Insurance companies love it when you bring them more business—and they’ll often reward you with discounts. By bundling your auto + home, auto + renters, or even auto + life insurance, you can save 10–25%.

📌 Example: A driver paying $165/month for car insurance and $100/month for homeowners might pay just $225 total when bundled—saving $40/month.

Keep a Clean Driving Record

Tickets, accidents, and claims can hike up your premium for 3–5 years. Staying claim-free not only keeps your rate lower—it may also earn you a safe driver discount (up to 20% off in some cases).

💡 Tip: If you have a spotty record, consider a defensive driving course to offset some of the rate increase.

Raise Your Deductible (If You Can Afford It)

Your deductible is what you pay out of pocket before insurance kicks in. A higher deductible means a lower monthly rate. Just make sure you have enough saved to cover that amount if needed.

📌 Example: Raising your collision deductible from $500 to $1,000 might lower your monthly bill by $20–$40.

Use Every Discount Available

There are dozens of discounts that might apply to you—including ones for:

Good students (usually a 3.0 GPA or higher)

Low-mileage drivers (under 7,500 miles/year)

Military or veteran status

Anti-theft devices or safety features

Paperless billing or auto-pay enrollment

Family or multi car discount (Insure more than one vehicle or multiple drivers like a spouse or teen on the same policy.)

📌 Tip: Always ask your agent to do a full discount check—you might be missing out on savings.

Compare Quotes Every Year

Rates can change even if nothing else does. Your current insurer might raise rates quietly, while a competitor is offering a better deal. Shopping around once a year helps ensure you’re still getting a fair price. Review your quote after each of these events:

A birthday milestone (like turning 25)

Paying off a car loan

Moving to a new ZIP code

Improving their credit score

Removing a driver from the policy

💡 Pro tip: Ask for an independent agent (like us at Landeche!) to compare options for you across multiple carriers.

Accidents can happen at any time. Protect yourself and others with a policy designed specifically for your needs.

FAQs

Frequently Asked Questions About Car Insurance in Louisiana

-

Between $150–$200, depending on coverage, location, driver profile, and history.

-

Yes—liability-only plans typically cost $100–$140/month, but offer minimal protection in a serious accident.

-

Absolutely—teens often pay $250–$350+/mo. Rates drop significantly by age 25 if they maintain a clean record.

-

Yes—adding a teen usually increases your premium by $50–$100+ per month. Consider adding them to a student discount.

-

Definitely—areas with high flood or hurricane risk can see 15–25% higher premiums.

-

Annually—shop around, update discounts, and adjust coverage to make sure you’re not overpaying.

Key Takeaways

Average monthly premiums are $150–$200, but can range from $100 to $300+

Factors: age, driving history, coverage levels, city vs rural

Safe driving, bundling policies, clean record all help lower rates

Louisiana's flood & weather risks can increase premiums

Shop around every year and ask about local discounts

About Landeche Insurance

Information about Landeche Insurance.

👉 Click here to get your quick, no-hassle quote today.

Have questions? Give us a call! 👉 Call 504-228-7184.

Hi, I’m Ronnie — founder of Landeche Insurance. I’m a lifelong Louisiana resident who believes insurance should be honest, local & easy to understand.

Protecting Louisiana families & property for 20+ years. Experts in homeowners, flood, auto, landlord, life & classic car insurance (& more) — with clear advice & coverage that fits you. Based in Louisiana. Real help from real people. 👉 Call 504-228-7184.